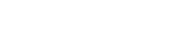

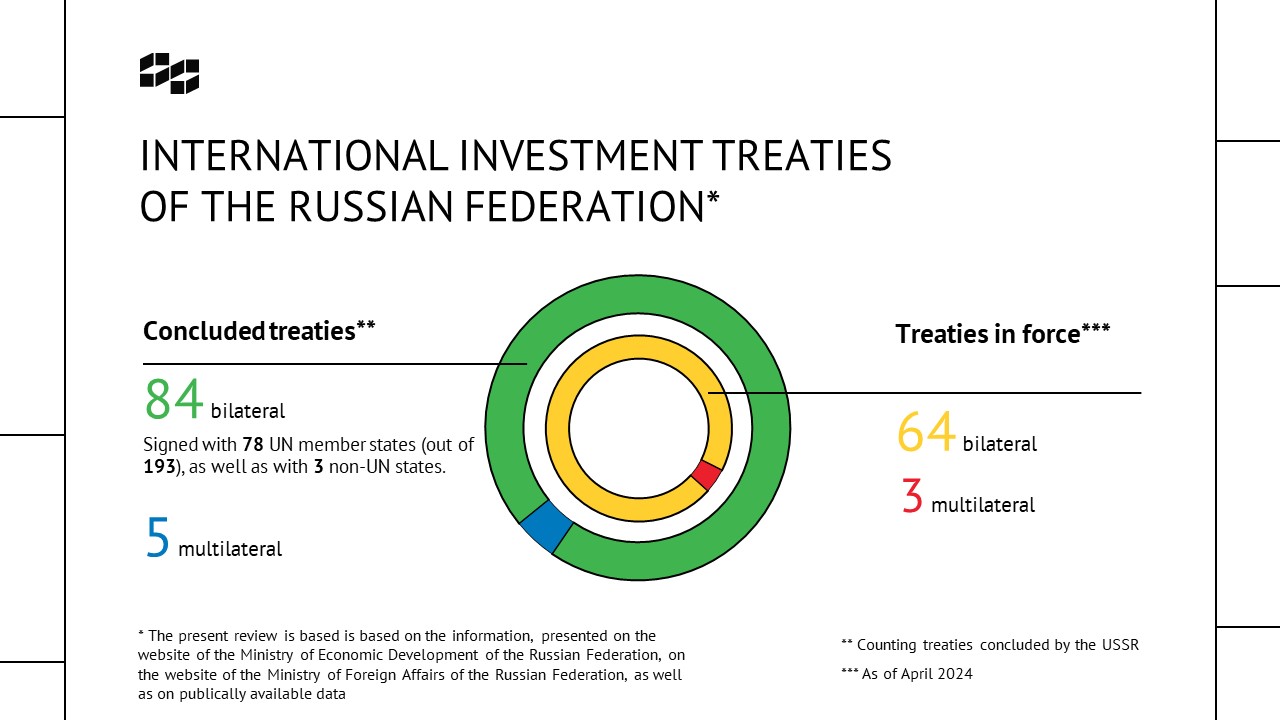

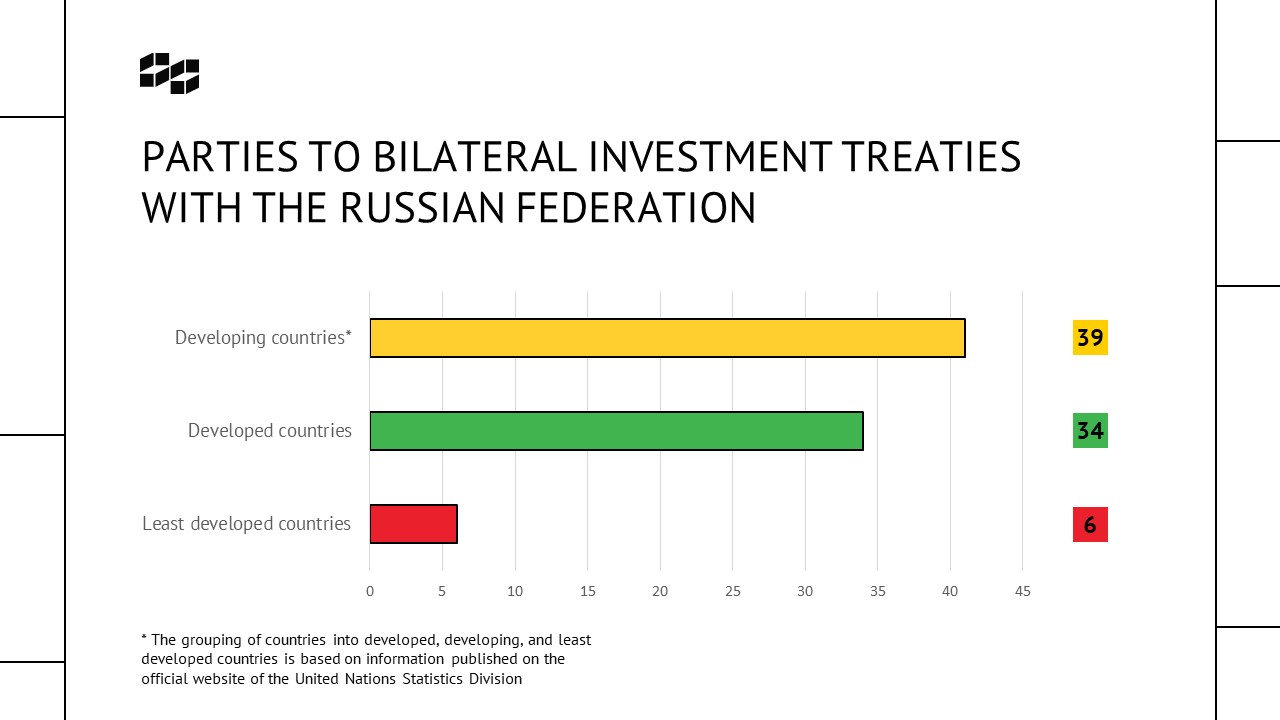

International Investment Treaties of the Russian Federation: Brief Overview

List of Investment Treaties with the Participation of the Russian Federation see in the attached file.

OTHER PUBLICATONS

.jpg)

Areas of professional expertise: Education In 2013, Aleksei graduated from the IKBFU (Kaliningrad). In 2015, he obtained an LL.M. degree with a specialization in international law from the University of Göttingen (Germany). He also completed an exchange semester at the University of Kiel (Germany). In 2024, the degree of Doctor of Law (Dr. jur.) was awarded following the defence of the dissertation at the University of Göttingen. The dissertation was written in the field of international law and concerned the right to regulate in investment and trade law. In 2016, Aleksei received the “International Law in the 21st Century” Award from the ICLRC. The previous year, the Society of International Economic Law highly commended his paper on WTO law in an essay competition on international economic law. Professional Experience From 2016 to 2017, Aleksei worked as a research assistant at the Institute of International and European Law at the University of Göttingen. Later, Aleksei joined the WTO Expertise Center in Moscow, where he handled inter-State trade disputes from 2017 to 2019. He was a member of the litigation team that achieved the first win in a WTO dispute initiated by Russia. Aleksei participated in over ten inter-State disputes, including panel and Appellate Body proceedings, representing complainants, respondents and third parties. He also took part in WTO committee meetings and conducted practical seminars on trade law for representatives of government agencies and large businesses. Aleksei has developed and taught law courses at three universities in both Russian and English. In 2022, he joined the School of International Law at the Faculty of Law of the Higher School of Economics (Moscow) as an Associate Professor, where he teaches subjects related to public international law. In 2024, Aleksei coached the winning team in the moot court competition "Dispute Settlement in the Eurasian Economic Union". He also received a certificate of appreciation from the School of International Law (HSE University). Before joining the ICLRC, Aleksei worked with the Center as an expert, and in 2020, he officially became part of the team, focusing on issues linked to public international law.

Author of the monograph: Petrenko, Aleksei. The Right to Regulate in International Economic Law: Towards a General Theory with Lessons from the GATS / A. Petrenko. - Göttingen : Universitätsverlag Göttingen, 2024. - 227 p.

.jpg)

Sergey Korotkov specializes in public international law, in particular treaty law, international investment law, as well as certain aspects of trade policy and sustainable development. He acts as an independent consultant working with intergovernmental and non-governmental organizations, providing legal advice on international treaty-making, investment dispute risk mitigation, human rights, humanitarian law and the law of international organizations. Sergey has also interned in the legal departments of the United Nations and the Hong Kong International Arbitration Center (HKIAC), as well as in the Project Department of the International Trade Center (ITC). He received his legal education in Russia and in the USA.

.jpg)

In addition to her work at the Center, Valeria is General of the Russian Arbitration Center (RAC). Valeria is engaged in research work, including on issues considered by UNCITRAL, participates in the development of various RAC arbitration rules, and organizes educational projects on alternative dispute settlement.

As part of her expert work, Valeria participates in research on investment law and international commercial and investment arbitration.

Previously, Valeria worked for a major Russian law firm and acted as a representative in state courts.

She is fluent in Russian and English, basic level of German.